Inna Kot

A Quick Take On Rocket Companies

Rocket Companies, Inc. (NYSE:RKT) reported its Q3 2022 financial results on November 3, 2022, missing revenue and EPS estimates.

The firm provides a range of mortgage loan origination and consumer loan financial services in the United States.

Given RKT’s approach to “hunkering down” for the period ahead, my outlook on the stock is cautious.

I’m Neutral for RKT in the near term.

Rocket Companies Overview

Detroit, Michigan-based Rocket Companies, Inc. was founded as Quicken Loans and has rebranded to Rocket Loans (and various permutations for other service offerings).

Management is headed by Founder and Chairman Dan Gilbert. CEO Jay Farner has been with the firm since 1996.

The company’s primary offerings include:

-

Rocket Homes & Mortgage – Home search and financing

-

Amrock – Title insurance and related services

-

Rocket Auto – Auto sales facilitation

-

Rocket Loans – Personal, unsecured loans

-

Lendesk – Canada

-

Edison Financial – Canada

-

Core Digital Media – Social and display lead generator.

The firm acquires customers through a range of online and offline lead-generation activities as well as through partners.

RKT is active in offline advertising at major sporting events in sports such as basketball, golf, and football.

According to a 2020 market research report, the global market for digital lending is forecast to reach $11.6 billion by 2025, although other reports show higher or lower forecasts.

This represents a forecast CAGR of 20.3{9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} from 2020 to 2025.

The main drivers for this expected growth are a desire by younger demographic consumers to utilize faster and more transparent online processes along with the lower processing cost to lenders.

Also, the market may be slowed somewhat by security issues related to new functionality development.

Rocket’s Recent Financial Performance

-

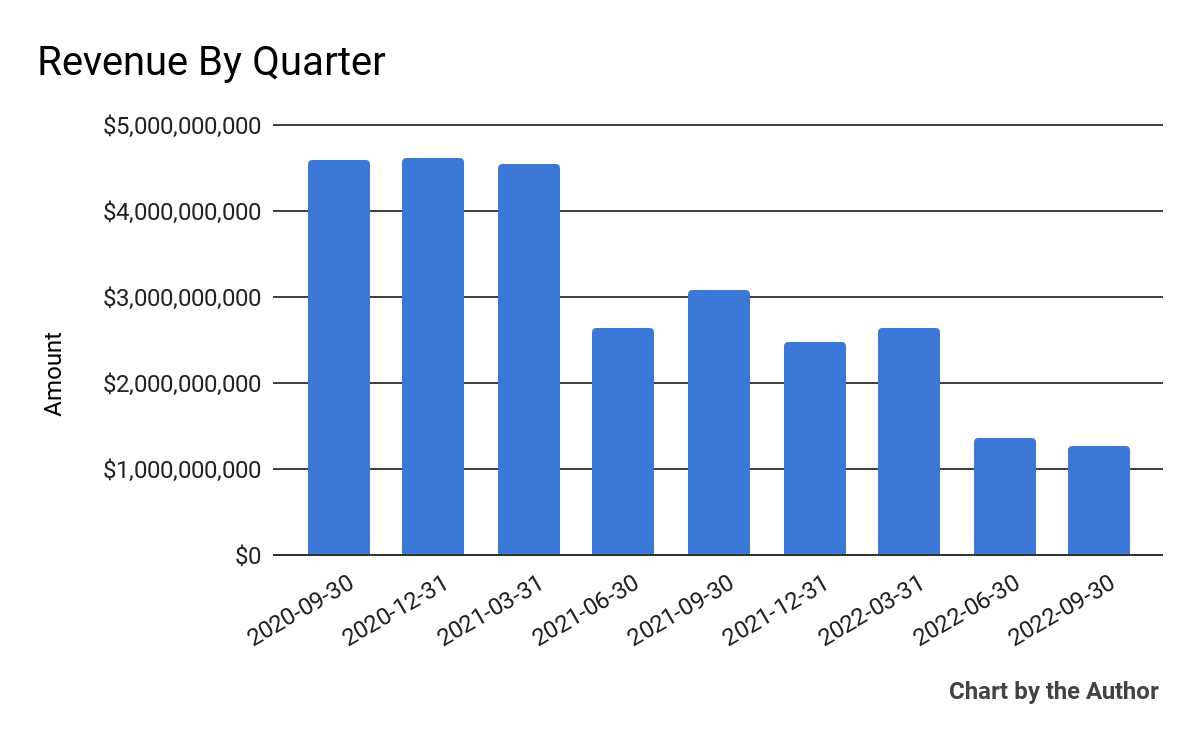

Total revenue by quarter has continued to shrink substantially in recent quarters:

9 Quarter Total Revenue (Financial Modeling Prep)

-

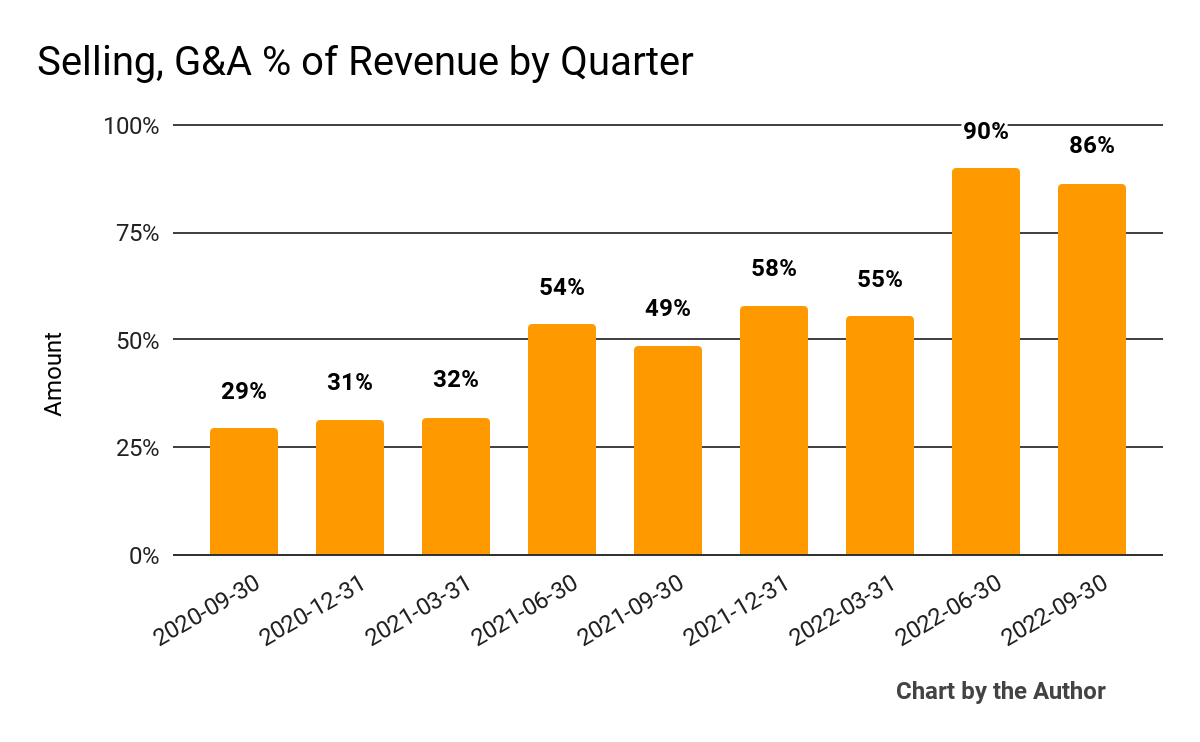

Selling, G&A expenses as a percentage of total revenue by quarter have risen sharply recently:

9 Quarter Selling, G&A {9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} Of Revenue (Financial Modeling Prep)

-

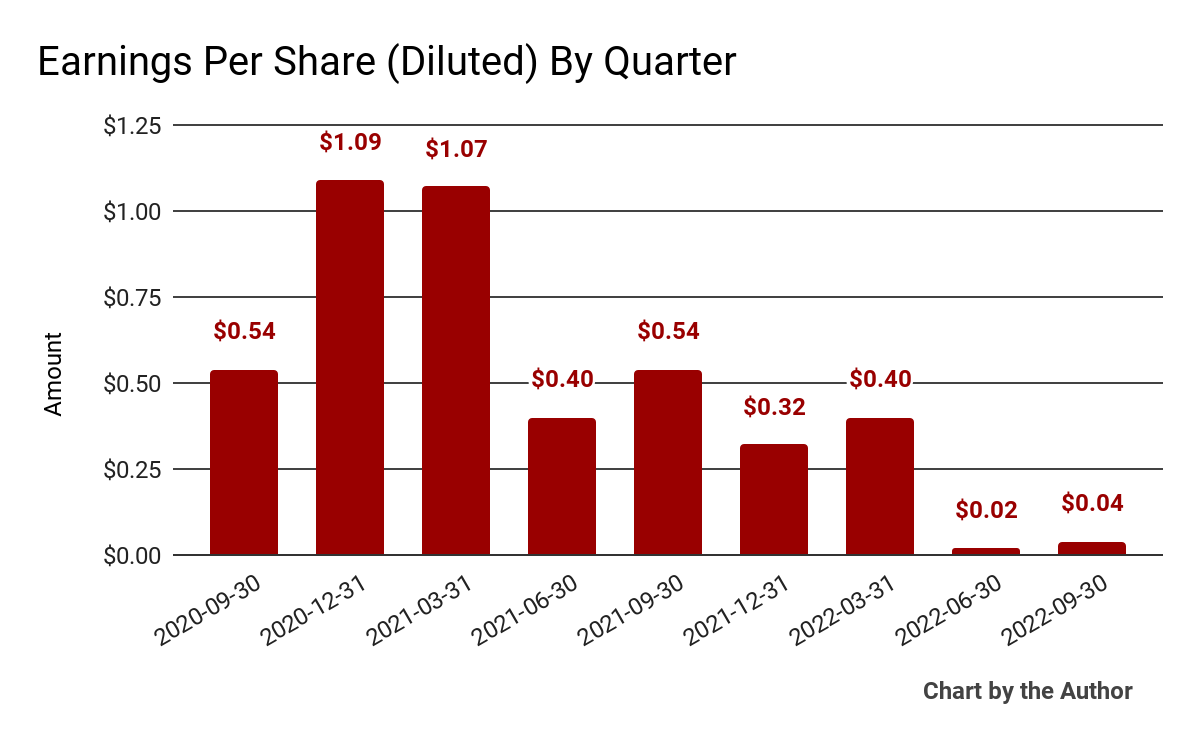

Earnings per share (Diluted) have dropped to nearly breakeven, as the chart shows here:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP.)

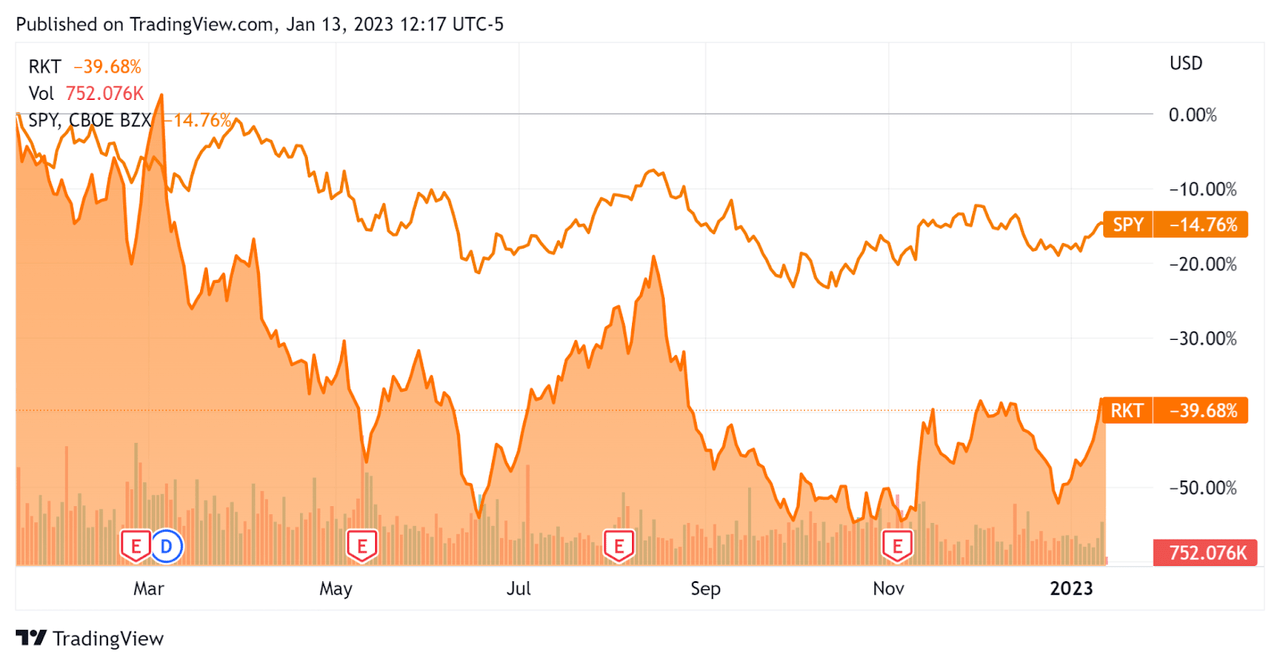

In the past 12 months, Rocket Companies, Inc.’s stock price has fallen 39.7{9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} vs. the U.S. S&P 500 Index’s (SP500) drop of around 14.8{9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d}, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Rocket Companies

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.4 |

|

Enterprise Value / EBITDA |

15.6 |

|

Revenue Growth Rate |

-48.2{9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} |

|

Net Income Margin |

1.5{9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} |

|

GAAP EBITDA {9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} |

8.6{9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} |

|

Market Capitalization |

$17,031,159,808 |

|

Enterprise Value |

$10,414,142,856 |

|

Earnings Per Share (Fully Diluted) |

$0.78 |

(Source – Financial Modeling Prep.)

Commentary On Rocket Companies

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the “challenging times” the U.S. mortgage industry faces with a rapid rise in the cost of capital and a 30-year low in housing affordability.

In response, Rocket Companies, Inc. has instituted various cost structure reductions and related plans that management says will reduce its cost structure by one-third, or $2 billion per year.

That said, the firm seeks to continue investing in technology enhancements that leadership believes will separate it from others in the space during downtimes like the current part of the cycle.

As to its financial results, revenue dropped 58{9104a15e8d43cffaa82b7b4c643401a24474a83108be38dc3b050cba43a4940d} year-over-year and SG&A costs as a percentage of revenue rose sharply.

Operating income dropped from $1.5 billion in Q3 2021 to $191 million in Q3 2022, while earnings per share fell to $0.04.

For the balance sheet, Rocket Companies, Inc. finished the quarter with $833.7 million in cash, equivalents and trading asset securities and $11.2 billion in total debt.

Over the trailing twelve months, free cash flow was $13.9 billion, of which capital expenditures accounted for $107.7 million. The company paid $208.2 million in stock-based compensation.

Looking ahead, for Q4 2022, management guided to $675 million in adjusted revenue at the midpoint of the range.

Regarding valuation, the market is valuing RKT at an EV/Revenue multiple of 1.4x.

The primary risk to Rocket Companies, Inc.’s outlook is the continued elevated cost of money combined with a slowing economy and consumers who are tapping credit card debt to maintain consumption.

There is a significant divergence of opinion as to how the U.S. economy will fare in 2023, as well as the trajectory of interest rates.

Furthermore, real estate downturns can last for years at a time, so the duration and depth of the current downturn underway is a complete unknown.

Some market participants are quite negative about the U.S. market in 2023.

As Pulte Capital (PHM) CEO Bill Pulte recently said,

When you have a rise and increase in interest rates like we’ve had, that is a big problem for housing. Interest rates are like the mother’s milk of housing. And if you cut it off, you’re in big trouble. And when you’ve had these massive increases in interest rates, it just puts a lot of things to a stop.

Given Rocket Companies, Inc.’s approach to hunkering down for the troubled period ahead, my outlook on the stock is cautious.

I’m on Hold for Rocket Companies, Inc. in the near term.